Fundamentals of Engineering Exam....

(US, Canada, Egypt, UAE, Qatar, Saudi Arabia, Turkey, Japan, Korea, Taiwan)

Pass with confidence !!

FE Exam Revision Lectures

Absolutely free... Every Saturday !!

In a hurry?

just now !!

Please check a demo topic from Straight Line

What we offer

One stop solution to help you pass the FE Exam

Web Access

6 or 12 month web access to our video library, solved examples and notes.

Also available as till-you-pass access.

Web Access with Individual Coaching

One-on-one tutoring to clarify your doubts and identify weaker areas.

Strongly recommended if you are out-of-college for a long time.

Test Assessment

Mock tests to give you confidence before facing the actual exam.

Strongly recommended for last minute confidence boosting.

Stimulating Content, Motivating Minds, Yes..that's easy on eyes too !!

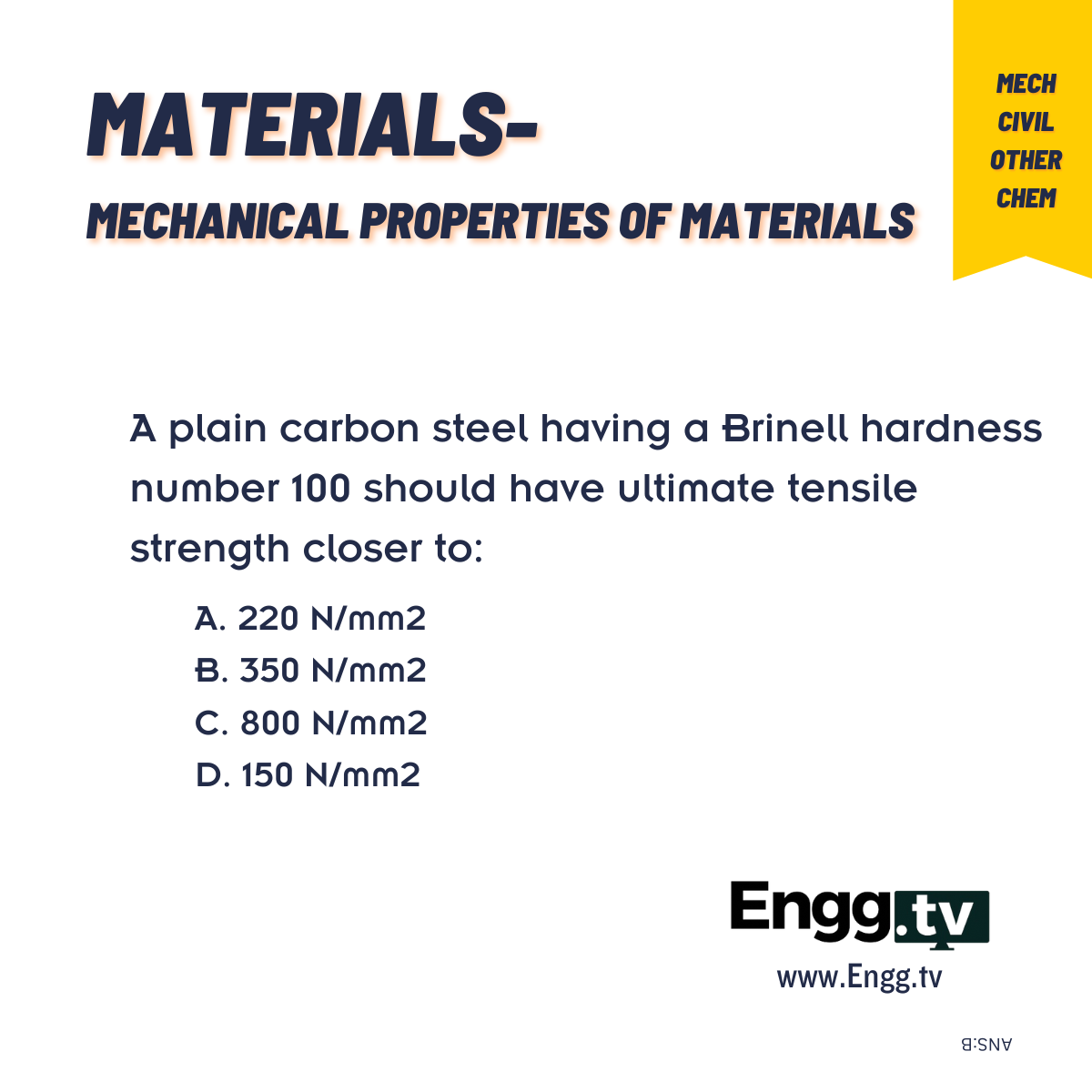

A new question delivered everyday

Testimonials

What our students are saying about ENGG.tv

F.A.Q

About ENGG.tv

The contents of ENGG.tv website are created with end-user in mind. The error-free contents are

created and verified by experts who have several years of teaching experience and practical hands-on

experience from industries. The site is mobile-friendly, easy to navigate and advertisement-free. Our

mission is to make it easy for working professionals and students to excel in competitive exams by

refreshing their knowledge and by providing them guided learning opportunities.

Currently, we have 135 videos and more than 3000 solved examples, with 101 topic notes for subjects for Mechanical, Civil, Chemical, Industrial, Electrical/Computer and Other discipline as defined by the NCEES.

New solved examples and video explanations are added every day.